DATE: | Thursday, May 4, 2017 | TIME: | 1. | 2 p.m. Pacific Daylight Time | VIRTUAL MEETING ACCESS: | | www.proxyvote.com | MATTERS TO BE VOTED ON: | | 1. to elect to the Board of Directors the 1110 nominees named in this Proxy Statement, each for a one-year term; |

| 2. | to seek an advisory vote to approve the compensation of the Company’s Named Executive Officers; 3. to seek an advisory vote to approve the frequency of the advisory vote to approve the compensation of the Company’s Named Executive Officers; 4. to approve an amendment to the Company’s Certificate of Incorporation to increase the number of authorized shares; 5. to ratify the appointment of KPMG LLP as the Company’s independent registered public accountants (the independent accountants) for fiscal year 2015; |

2017; | 3. | to seek an advisory vote to approve the compensation of the Company’s Named Executive Officers; |

| 4. | 6. to consider a stockholder proposal regarding an independent board chairman policy;changes to the Company’s proxy access bylaw; and |

| 5. | 7. to transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

The Board of Directors set Friday, March 18, 201510, 2017 as the record date for the Annual Meeting. This means that owners of Alaska Air Group common stock as of the close of business on that date are entitled to receive this notice, attend the meeting in person with proper proof of ownership or by proxy (seeCan I attend the Annual Meeting, and what do I need for admission? in the following Questions and Answers About the Annual Meeting section of this Proxy Statement); and vote at the meeting and any adjournments or postponements. Whether or not you attend the meeting in person, we encourage you to vote by Internet or phone or to complete, sign and return your proxy prior to the meeting.

Because the majority of our stockholders will not be able to attend in person, we invite you to submit any questions you may have that would be of general stockholder interest to the Corporate Secretary via email at shannon.alberts@alaskaair.com. We will include as many of your questions as possible during the Q&A session of the meeting and will send you a copy of the response. Every stockholder vote is important. To ensure your vote is counted at the Annual Meeting, please vote as promptly as possible.

By Order of the Board of Directors,

Shannon K. Alberts

Corporate Secretary

March 27, 2015

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY

MATERIALS FOR THE STOCKHOLDERS MEETING TO BE HELD ON MAY 7, 2015.

Stockholders may access, view and download the 2015 Proxy Statement and 2014 Annual Report atwww.edocumentview.com/alk.

ALASKA AIR GROUP, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

TABLE OF CONTENTS

| Annual Meeting Information |

The Board of Directors of Alaska Air Group, Inc. (Air Group or the Company) is soliciting proxies for the 2015 Annual Meeting of Stockholders. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before thevirtual meeting. Please read it carefully.

The Board set March 18, 2015 as the record date for the meeting. Stockholders who owned Air Group common stock on that date are entitled to vote at the meeting, with each share entitled to one vote. There were 130,869,463[XXX,XXX,XXX] shares of Air Group common stock outstanding on the record date.

Internet Availability of Annual Meeting Materials Proxy Materials. On or about March 27, 2015,24, 2017, stockholders of record, beneficial owners and employee participants in the Company’s 401(k) plans were mailed a Notice of Internet Availability of Proxy Materials (the Notice) directing them to a website where they can access the Company’s 20152017 Proxy Statement and 2014 Annual Report (the Annual Meeting Materials). The Company’son Form 10-K for the year ended December 31, 2014 is included in the 20142016 (the Annual Report. ItMeeting Materials). The Company’s 2016 Form 10-K was filed with the Securities and Exchange Commission (SEC) on February 11, 2015. 28, 2017. If you would prefer to receive a paper copy of the proxy materials, please follow the instructions printed on the Noticenotice and the material will be mailed to you. All stockholders may access, view and downloadAttending the Annual Meeting. We will host the 2017 Annual Meeting Materials atwww.edocumentview.com/alk. Other information onlive via the website does not constitute part of this Proxy Statement.

AdmissionInternet only. Any stockholder can listen to and participate in the Annual Meeting

IfMeeting. Whether or not you would like to attend the meeting, in person,we encourage you must present proofto vote by Internet or phone or to complete, sign and mail your voting instruction form or proxy prior to the meeting.

Submit Your Questions. We invite you to submit any questions of stock ownershipgeneral stockholder interest you may have to the Corporate Secretary via email at shannon.alberts@alaskaair.com, or via the Shareholder Forum at www.proxyvote.com. We will include as many of your questions as possible during the Q&A session of the record date along with valid, government-issued photo identification. For further details, see Can I attendmeeting and will send you a copy of the Annual Meeting, and what do I need for admission? in the following Questions and Answers About the Annual Meeting section of this Proxy Statement. Questions and Answers about the Annual Meetingresponse.

Why am I receiving the Annual Meeting Material?

You are receiving the Annual Meeting Material from us because you owned Air Group common stock as of the record date for the Annual Meeting. This Proxy Statement describes issues on which you may vote and provides you with other important information so that you can make informed decisions.

You may own shares of Air Group common stock in several different ways. If your stock is represented by one or more stock certificates registered in your name or if you have a Direct Registration Service (DRS) advice evidencing shares held in book entry form, then you have a stockholder account with the Company’s transfer agent, Computershare Trust Company, N.A. (Computershare), and you are a stockholder of record. If you hold your shares in a brokerage, trust, or similar account, then you are the beneficial owner but not the stockholder of record of those shares. Employees of the Company’s subsidiaries who hold shares of stock in one or more of the Company’s 401(k) retirement plans are beneficial owners.

What am I voting on?

You are being asked to vote on the election of the 11 director nominees named in this Proxy Statement, to ratify the appointment of KPMG LLP as the Company’s independent accountants, to provide an advisory vote in regard to the compensation of the Company’s Named Executive Officers, and to vote on a stockholder proposal regarding an independent chairman

policy. When you sign and mail the proxy card or submit your proxy by phone or the Internet, you appoint each of Bradley D. Tilden and Shannon K. Alberts, or their respective substitutes or nominees, as your representatives at the meeting. (When we refer to the “named proxies,” we are referring to Mr. Tilden and Ms. Alberts.) This way, your shares will be voted even if you cannot attend the meeting.ALASKA AIR GROUP, INC.

How does the Board of Directors recommend I vote on each of the proposals?NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

TABLE OF CONTENTS FOR the election of each of the Board’s 11 director nominees named in this Proxy Statement;

FOR the ratification of the appointment of KPMG LLP as the Company’s independent accountants for fiscal year 2015;

FOR the ratification of the compensation of the Company’s Named Executive Officers;

AGAINST the stockholder proposal regarding an independent chairman policy.

How do I vote my shares?

Stockholders of record can vote by using the proxy card or by phone or the Internet.

Beneficial owners whose stock is held:

in a brokerage account can vote by using the voting instruction form provided by the broker or by phone or the Internet;

by a bank, and who have the power to vote or to direct the voting of the shares, can vote using the proxy or the voting information form provided by the bank or, if made available by the bank, by phone or the Internet;

in trust under an arrangement that provides the beneficial owner with the power to vote or to direct the voting of the shares can vote in accordance with the provisions of such arrangement; and/or

in trust in one of the Company’s 401(k) retirement plans can vote by telephone or internet, or by mailing the voting instruction form provided by the trustee.

Beneficial owners other than those who beneficially own stock held in trust in one of the Company’s 401(k) retirement plans can vote at the meeting provided that he or she obtains a “legal proxy” from the person or entity holding the stock for him or her (typically a broker, bank, or trustee). A beneficial owner can obtain a legal proxy by making a request to the broker, bank, or trustee. Under a legal proxy, the bank, broker, or trustee confers all of its rights as a record holder to grant proxies or to vote at the meeting.

Listed below are the various means you can use to vote your shares without attending the Annual Meeting.

You can vote on the Internet.

Stockholders of record and beneficial owners of the Company’s common stock can vote via the Internet regardless of whether they receive their annual meeting materials through the mail or via the Internet. Instructions for voting are provided along with your notice, proxy card or voting instruction form. If you vote on the Internet, please do not mail your proxy card if you received one (unless you intend for it to revoke your prior Internet vote). Your Internet vote will authorize the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

You can vote by phone.

Stockholders of record and beneficial owners of the Company’s common stock can vote by phone. Instructions are provided along with your proxy card or voting instruction form. If you vote by phone, do not mail your proxy card if you received one (unless you intend for it to revoke your prior vote submitted by phone). Your vote by phone will authorize the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

You can vote by mail.

1 If you received this Proxy Statement by mail, simply sign and date the enclosed proxy card or voting instruction form and mail it in the enclosed prepaid and addressed envelope. If you mark your choices on the card or voting instruction form, your shares will be voted as you instruct.

You can vote by telephone or by the Internet.

Internet and telephone voting facilities for stockholders of record and beneficial owners will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on Wednesday, May 6, 2015. To allow sufficient time for voting by the trustee, voting instructions for the Company’s 401(k) plan shares must be received no later than 11:59 p.m. Eastern Time on Monday, May 4, 2015.

Voting by the Internet or phone is fast and convenient and your vote is immediately confirmed and tabulated. By using the Internet or phone to vote, you help Alaska Air Group conserve natural resources and reduce postage and proxy tabulation costs.

How will my shares be voted if I return a blank proxy or voting instruction form?

If you sign and return a proxy card without giving specific voting instructions, your shares will be voted in accordance with the recommendations of the Board of Directors shown above and as the named proxies may determine in their discretion with respect to any other matters properly presented for a vote during the meeting or any postponement or adjournment of the meeting.

If my shares are held in a brokerage account, how will my shares be voted if I do not return voting instructions to my broker?

If you hold your shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may generally vote your shares in its discretion on matters designated as routine under the rules of the New York Stock Exchange (NYSE). However, a broker cannot vote shares held in street name on matters designated as non-routine by the NYSE, unless the broker receives voting instructions from the street name (beneficial) owner.

The proposal to ratify the appointment of the Company’s independent accountants for fiscal year 2015 is considered routine under NYSE rules. Each of the other items to be submitted for a vote is considered non-routine under applicable NYSE rules. Accordingly, if you hold your shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may exercise its discretion to vote your shares on the proposal to ratify the appointment of the Company’s independent accountants but will not be permitted to vote your shares on any of the other items. If your broker exercises this discretion, your shares will be counted as present for the purpose of determining a quorum at the Annual Meeting and will be voted on the proposal to ratify the Company’s independent accountants in the manner instructed by your broker, but your shares will constitute “broker non-votes” on each of the other items at the Annual Meeting.

For a description of the effect of broker non-votes on the proposals, see How many votes must the nominees have to be elected? and Not including the election of directors, how many votes must the proposals receive in order to pass?.

What other business may be properly brought before the meeting, and what discretionary authority is granted?

Under the Company’s Bylaws, as amended April 30, 2010, a stockholder may bring business before the meeting or for publication in the Company’s 2015 Proxy Statement only if the stockholder gave written notice to the Company on or before November 28, 2014 and complied with the other requirements included in Article II of the Company’s Bylaws.

The Company has not received valid notice that any business other than that described or referenced in this Proxy Statement will be brought before the meeting.

As to any other matters that may properly come before the meeting and are not on the proxy card, the proxy grants to Mr. Tilden and Ms. Alberts the authority to vote in their discretion the shares for which they hold proxies.

What does it mean if I receive more than one proxy card, voting instruction form or email notification from the Company?

It means that you hold Alaska Air Group stock in more than one account. Please complete and submit all proxies to ensure that all your shares are voted or vote by Internet or phone using each of the identification numbers.

What if I change my mind after I submit my proxy?

Stockholders, except for persons who beneficially own shares held in trust in one of the Company’s 401(k) retirement plans, may revoke a proxy and change a vote by delivering a later-dated proxy or by voting at the meeting. The later-dated proxy may be delivered by phone, Internet or mail and need not be delivered by the same means used in delivering the prior proxy submission.

Except for persons beneficially owning shares in one of the Company’s 401(k) retirement plans, stockholders may do this at a later date or time by:

voting by phone or the Internet before 11:59 p.m. Eastern Time on Wednesday, May 6, 2015 (your latest phone or Internet proxy will be counted);

signing and delivering a proxy card with a later date; or

voting at the meeting. (If you hold your shares beneficially through a broker, you must bring a legal proxy from the broker in order to vote at the meeting. Please also note that attendance at the meeting, in and of itself, without voting in person at the meeting, will not cause your previously granted proxy to be revoked.)

Persons beneficially owning shares in one of the Company’s 401(k) retirement plans cannot vote in person at the meeting and must vote in accordance with instructions from the trustees. Subject to these qualifications, such holders have the same rights as other record and beneficial owners to change their votes by phone or the Internet, however, in all cases your vote must be submitted by 11:59 p.m. Eastern Time on Monday, May 4, 2015.

Stockholders of record can obtain a new proxy card by contacting the Company’s Corporate Secretary, Alaska Air Group, Inc., P.O. Box 68947, Seattle, WA 98168, telephone (206) 392-5719.

Stockholders with shares held by a broker, trustee or bank can obtain a new voting instruction form by contacting your broker, trustee or bank.

Stockholders whose shares are held in one of the Company’s 401(k) retirement plans can obtain a new voting instruction form by contacting the trustee of such plan. You can obtain information about how to contact the trustee from the Company’s Corporate Secretary. Please refer to the section below titledHow are shares voted that are held in a Company 401(k) plan? for more information.

If you sign and date the proxy card or voting instruction form and submit it in accordance with the accompanying instructions and in a timely manner, any earlier proxy card or voting instruction form will be revoked and your new choices will be voted.

How are shares voted that are held in the Company’s 401(k) plan?

On the record date, 3,822,103 shares were held in trust for Alaska Air Group 401(k) plan participants. The trustees, Vanguard Fiduciary Trust Company (Vanguard) and Fidelity Management Trust Company (Fidelity), provided Notice of Proxy and Access instructions to each participant who held shares through the Company’s 401(k) plans on the record date. The trustees will vote only those shares for which instructions are received from participants. If a participant does not indicate a preference as to a matter, including the election of directors, then the trustees will not vote the participant’s shares on such matters.

To allow sufficient time for voting by the trustee, please provide voting instructions no later than 11:59 p.m. Eastern Time on Monday, May 4, 2015. Because the shares must be voted by the trustee, those who hold shares through the 401(k) plans may not vote these shares at the meeting.

Can I attend the Annual Meeting, and what do I need for admission?

Admission to the Annual Meeting is limited to Air Group stockholders as of March 18, 2015 and persons holding valid proxies from stockholders of record. To be admitted to the Annual Meeting, you must present proof of your stock ownership as of the record date and valid, government-issued photo identification. Acceptable proof of stock ownership includes:

the admission ticket attached to the top of your proxy card (or made available by Computershare if you submit your proxy online);

a copy of the Notice of Proxy and Access Instructions you received by mail;

a photocopy of your voting instruction form;

a letter from your bank or broker confirming your ownership as of the record date;

a brokerage statement evidencing ownership of shares of Alaska Air Group stock as of the record date; or

If you do not provide photo identification or comply with the other procedures outlined above upon request, you will not be admitted to the Annual Meeting. Guests of stockholders will not be admitted unless they provide their own proof of ownership according to the criteria outlined above.

Each stockholder of record or beneficial stockholder, including institutional holders, may designate one person to represent their shares at the meeting. If multiple representatives request admission on behalf of the same stockholder, the first person to register at the door with appropriate proof of ownership and proper delegation of voting authority will be allowed to attend the meeting.

Security measures may include bag search, metal detector and hand-wand search. The use of cameras (including cell phones with photographic capabilities), recording devices, smart phones and other electronic devices is strictly prohibited.

May I vote in person at the meeting?

We will provide a ballot to any record holder of the Company’s stock who requests one at the meeting. If you hold your shares through a broker, you must bring a legal proxy from your broker in order to vote by ballot at the meeting. You may request a legal proxy from your broker to attend and vote your shares at the meeting by marking your voting instruction form or the Internet voting site to which your voting materials direct you. Please allow sufficient time to receive a legal proxy through the mail after your broker receives your request. Because shares held by participants in the Company’s 401(k) plans must be voted by the trustee, these shares may not be voted at the meeting.

How can I reduce the number of annual meeting materials I receive?

10 If you are a stockholder of record receiving multiple copies of the annual meeting materials either because you have multiple registered stockholder accounts or because you share an address with other registered stockholders, and you would like to discontinue receiving multiple copies, you can contact the Company’s transfer agent, Computershare, by telephone at (877) 282-1168 or by writing to them c/o Computershare, P.O. Box 30170, College Station, TX 77842-3170.

If you are a beneficial stockholder, but not a registered stockholder, and you share an address with other beneficial stockholders, the number of annual meeting materials you receive is already being reduced because your broker, bank or other institution is permitted to deliver a single copy of this material for all stockholders at your address unless a stockholder has requested separate copies. If you would like to receive separate copies, please contact your broker, bank or institution and update your preference for future meetings.

Can I receive future materials via the Internet?

If you vote on the Internet, simply follow the prompts for enrolling in electronic proxy delivery service. This will reduce the Company’s printing and postage costs, as well as the number of paper documents you will receive.

Stockholders of record may enroll in that service at the time they vote their proxies via the Internet or at any time after the Annual Meeting and can read additional information about this option and request electronic delivery by going towww.computershare.com/investor. If you hold shares beneficially, please contact your broker to enroll for electronic proxy delivery.

At this time, employee participants in a Company 401(k) plan may not elect to receive notice and proxy materials via electronic delivery.

If you already receive your proxy materials via the Internet, you will continue to receive them that way until you instruct otherwise through the methods referenced above.

How many shares must be present to hold the meeting?

A majority of the Company’s outstanding shares entitled to vote as of the record date, or 65,434,732 shares, must be present or represented at the meeting and entitled to vote in order to hold the meeting and conduct business (i.e., to constitute a quorum). Shares are counted as present or represented at the meeting if the stockholder of record attends the meeting; if the beneficial owner attends with a “legal proxy” from the record holder; or if the record holder or beneficial owner has submitted a proxy or voting instructions, whether by returning a proxy card or a voting instruction form or by phone or Internet, without regard to whether the proxy or voting instructions actually casts a vote or withholds or abstains from voting.

How many votes must the nominees have to be elected?

The Company’s Bylaws (as amended April 30, 2010) require that each director be elected annually by a majority of votes cast with respect to that director. This means that the number of votes “for” a director must exceed the number of votes “against” that director. In the event that a nominee for director receives more “against” votes for his or her election than “for” votes, the Board must consider such director’s resignation following a recommendation by the Board’s Governance and Nominating Committee. The majority voting standard does not apply, however, in the event that the number of nominees for director exceeds the number of directors to be elected. In such circumstances, directors will instead be elected by a plurality of the votes cast, meaning that the persons receiving the highest number of “for” votes, up to the total number of directors to be elected at the Annual Meeting, will be elected.

With regard to the election of directors, the Board intends to nominate the 11 persons identified as its nominees in this Proxy Statement. Because the Company has not received notice from any stockholder of an intent to nominate directors at the Annual Meeting, each of the directors must be elected by a majority of votes cast.

“Abstain” votes and broker non-votes are not treated as votes cast with respect to a director and therefore will not be counted in determining the outcome of the election of directors.

What happens if a director candidate nominated by the Board of Directors is unable to stand for election?

The Board of Directors may reduce the number of seats on the Board or it may designate a substitute nominee. If the Board designates a substitute, shares represented by proxies held by the named proxies will be voted for the substitute nominee.

Not including the election of directors, how many votes must the proposals receive in order to pass?

Ratification of the appointment of KPMG LLP as the Company’s independent accountants

A majority of the shares present in person or by proxy at the meeting and entitled to vote on the proposal must be voted “for” the proposal in order for it to pass. “Abstain” votes are deemed present and entitled to vote and are included for purposes of determining the number of shares constituting a majority of shares present and entitled to vote. Accordingly, an abstention, because it is not a vote “for” will have the effect of a negative vote.

Advisory vote regarding the compensation of the Company’s Named Executive Officers

A majority of the shares present in person or by proxy at the meeting and entitled to vote on the proposal must be voted “for” the proposal in order for it to pass. “Abstain” votes are deemed present and entitled to vote and are included for purposes of determining the number of shares constituting a majority of shares present and entitled to vote. Accordingly, an abstention, because it is not a vote “for” will have the effect of a negative vote. In addition, broker non-votes are not considered entitled to vote for purposes of determining whether the proposal has been approved by stockholders and therefore will not be counted in determining the outcome of the vote on the proposal.

Stockholder proposal regarding an independent chairman policy

A majority of the shares present in person or by proxy at the meeting and entitled to vote on the proposals must be voted “for” the proposal in order for it to pass. “Abstain” votes are deemed present and entitled to vote and are included for purposes of determining the number of shares constituting a majority of shares present and entitled to vote. Accordingly, an abstention, because it is not a vote “for” will have the effect of a negative vote. In addition, broker non-votes are not considered entitled to vote for purposes of determining whether the proposal has been approved by stockholders and, therefore, will not be counted in determining the outcome of the vote on the proposal.

How are votes counted?

Voting results will be tabulated by Computershare. Computershare will also serve as the independent inspector of election.

Is my vote confidential?

The Company has a confidential voting policy as a part of its governance guidelines, which are published on the Company’s website.

Who pays the costs of proxy solicitation?

The Company pays for distributing and soliciting proxies and reimburses brokers, nominees, fiduciaries and other custodians their reasonable fees and expenses in forwarding proxy materials to beneficial owners. The Company has engaged

Georgeson Inc. (Georgeson) to assist in the solicitation of proxies for the meeting. It is intended that proxies will be solicited by the following means: additional mailings, personal interview, mail, phone and electronic means. Although no precise estimate can be made at this time, we anticipate that the aggregate amount we will spend in connection with the solicitation of proxies will be approximately $33,000. To date, $29,000 has been incurred. This amount includes fees payable to Georgeson, but excludes salaries and expenses of the Company’s officers, directors and employees.

Is a list of stockholders entitled to vote at the Annual Meeting available?

A list of stockholders of record entitled to vote at the 2015 Annual Meeting will be available at the meeting. It will also be available Monday through Friday from March 30, 2015 through May 6, 2015 between the hours of 9 a.m. and 4 p.m., Pacific Time, at the offices of the Corporate Secretary, 19300 International Blvd., Seattle, WA 98188. A stockholder of record may examine the list for any legally valid purpose related to the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

We will publish the voting results on Form 8-K on or about May 13, 2015. You can read or print a copy of that report by going to Investor Information-SEC Filings atwww.alaskaair.com or by going directly to the SEC EDGAR files atwww.sec.gov. You can also request a copy by calling us at (206) 392-5719 or by calling the SEC at (800) SEC-0330 for the location of a public reference room.

How can I submit a proposal for next year’s annual meeting?

The Company expects to hold its next annual meeting on or about May 5, 2016. If you wish to submit a proposal for inclusion in the proxy materials for that meeting, you must send the proposal to the Corporate Secretary at the address below. The proposal must be received at the Company’s corporate offices no later than November 28, 2015 to be considered for inclusion. Among other requirements set forth in the SEC’s proxy rules and the Company’s Bylaws, you must have continuously held a minimum of either $2,000 in market value or 1% of the Company’s outstanding stock for at least one year by the date of submitting the proposal, and you must continue to own such stock through the date of the meeting.

If you intend to nominate candidates for election as directors or present a proposal at the meeting without including it in the Company’s proxy materials, you must provide notice of such proposal to the Company no later than February 5, 2016. The Company’s Bylaws outline procedures for giving the required notice. If you would like a copy of the procedures contained in The Company’s Bylaws, please contact:

Corporate Secretary

Alaska Air Group, Inc.

P.O. Box 68947

Seattle, WA 98168

10 The Company’s Bylaws provide that directors shall serve a one-year term. Directors are elected to hold office until their successors are elected and qualified, or until resignation or removal in the manner provided in the Company’s Bylaws. Eleven directors are nominees for election this year and each has consented to serve a one-year term ending in 2016.

Patricia M. Bedient

Director since 2004

Age – 61

Ms. Bedient chairs the Board’s Audit Committee. In January 2015, Ms. Bedient was also appointed a member of the Board’s Governance and Nominating Committee. She is executive vice president and CFO for The Weyerhaeuser Company, one of the world’s largest integrated forest products companies. A certified public accountant (CPA) since 1978, she served as managing partner of the Seattle office of Arthur Andersen LLP prior to joining Weyerhaeuser. Ms. Bedient also worked at Andersen’s Portland and Boise offices as a partner and as a CPA during her 27-year career with the firm. She serves on the boards of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), the Overlake Hospital Medical Center Board, the Oregon State University Board of Trustees, and the University of Washington Foster School of Business Advisory Board. She has also served on the boards of a variety of civic organizations, including the Oregon State University Foundation Board of Trustees, the World Forestry Center, City Club of Portland, St. Mary’s Academy of Portland, and the Chamber of Commerce in Boise, Idaho. She is a member of the American Institute of CPAs and the Washington Society of CPAs. Ms. Bedient received her bachelor’s degree in business administration, with concentrations in finance and accounting, from Oregon State University in 1975.

Ms. Bedient’s extensive experience in public accounting and financial expertise qualify her to serve on the Board and to act as an audit committee financial expert, as defined by the SEC.

Marion C. Blakey

Director since 2010

Age – 66

Ms. Blakey is chair of the Board’s Safety Committee. Ms. Blakey was recently named president and CEO of Rolls-Royce North America. For the last seven years, she was president and CEO of Aerospace Industries Association (AIA), the nation’s largest aerospace and defense trade association. Prior to her current position, she served as the Administrator of the Federal Aviation Administration (the FAA) from 2002 to 2007 and chair of the National Transportation Safety Board (the NTSB) from 2001 to 2002. Ms. Blakey also serves on the boards of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), Noblis, the NASA Advisory Council, the President’s Export Council Subcommittee on Export Administration (PECSEA), the Independent Takata Quality Assurance Panel, the International Coordinating Council of Aerospace Industries Associations (ICCAIA), as well as a number of philanthropic and community organizations, including the Washington Area Airports Task Force Advisory Board and the International Aviation Women’s Association.

Ms. Blakey’s experience with AIA, the FAA and the NTSB qualify her for service on the Company’s Board and, because of her experience with the FAA and NTSB, she brings a very relevant and important perspective to the deliberations of the Safety Committee.

Phyllis J. Campbell

Director since 2002

Age – 63

Ms. Campbell is lead director and chair of the Board’s Governance and Nominating Committee. She has been chairman of the Pacific Northwest Region for JPMorgan Chase & Co. since April 2009. She is the firm’s senior executive in Washington, Oregon, and Idaho , representing JPMorgan Chase at the most senior level. From 2003 to 2009, Ms. Campbell served as president and CEO of The Seattle Foundation, one of the nation’s largest community

philanthropic foundations. She was president of U.S. Bank of Washington from 1993 until 2001 and served as chair of the bank’s Community Board. Ms. Campbell has received several awards for her corporate and community involvement. These awards include Women Who Make A Difference and Director of the Year from the Northwest Chapter of the National Association of Corporate Directors. Since August 2007, Ms. Campbell has served on Toyota’s Diversity Advisory Board. She also serves on the boards of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group) and Nordstrom, where she chaired the audit committee until November 2013. Until February 2009, she served on the boards of Puget Energy and its subsidiary, Puget Sound Energy.

20 Ms. Campbell’s business and community leadership background and her extensive governance experience qualify her for her role as lead director of the Board.

Dhiren R. Fonseca

Director since 2014

Age – 50

Mr. Fonseca was appointed to the Alaska Air Group Board in October 2014. He is a member of the Board’s Audit Committee. He joined Certares LP as a partner in December 2014. Previously, Mr. Fonseca was chief commercial officer at Expedia, Inc., where he served for more than 18 years. He contributed greatly to the online travel company’s growth and success, serving in a host of key roles including co-president of its global partner services group and senior vice president of corporate development among others. Mr. Fonseca helped found Exedia.com as part of the management team at Microsoft Corporation that brought the online travel company to life in 1995 and subsequently took it public in 1999. Before Expedia, he held multiple roles in product management and corporate technical sales at Microsoft Corporation. Mr. Fonseca currently serves on the boards of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), Caesars Acquisition Corporation, eLong, Inc., and RentPath, Inc.

Mr. Fonseca’s expertise in the online travel services industry, combined with his management and technology experience at a major software and computer services company correspond with key aspects of the Company’s business strategy and qualify him for service on the Alaska Air Group Board.

Jessie J. Knight, Jr.

Director since 2002

Age – 64

Mr. Knight serves on the Board’s Safety Committee and its Governance and Nominating Committee. He also served on the Board’s Compensation and Leadership Development Committee during 2014. Mr. Knight is executive vice president of external affairs for Sempra Energy, as well as chairman of San Diego Gas and Electric Company and chairman of Southern California Gas Company, both subsidiaries of Sempra Energy. From 2010 to 2014, he was chairman and CEO of San Diego Gas & Electric. From 2006 to 2010, he was executive vice president of external affairs at Sempra Energy. From 1999 to 2006, Mr. Knight served as president and CEO of the San Diego Regional Chamber of Commerce, and from 1993 to 1998, he was a commissioner of the California Public Utilities Commission. Prior to this, for eight years, Mr. Knight was vice president of marketing and strategic planning for the San Francisco Chronicle and San Francisco Examiner newspapers. While there, he won five National Clio Awards for television, radio and printed advertising and a Cannes Film Festival Golden Lion Award for business marketing. Prior to his media career, Mr. Knight spent ten years in finance and marketing with the Dole Foods Company in its banana and pineapple businesses. Mr. Knight serves on the boards of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), the Timken Museum of Art in San Diego, the Southern California Leadership Council, and the University of California San Diego Foundation. He is a life member of the Council on Foreign Relations and is a corporate member of the Hoover Institution at Stanford University. He is a board member of the U.S. Chamber of Commerce, The Energy Institute and

| | | 10 | | PROPOSALS TO BE VOTED ON |

The Inter-American Dialogue. He previously served ten years on the board of the San Diego Padres Baseball Club. He served seven years on the board of Avista Corp., a utility in Spokane, Washington, where he served on the audit and governance committees, and as lead director.

Mr. Knight’s expertise in brand marketing, energy markets and economic development, as well as his broad business experience qualify him for service on the Alaska Air Group Board.

Dennis F. Madsen

Director since 2003

Age – 66

Mr. Madsen serves on the Board’s Compensation and Leadership Development Committee and its Audit Committee. From 2000 to 2005, Mr. Madsen was president and CEO of Recreational Equipment, Inc. (REI), a retailer and online merchant for outdoor gear and clothing. He served as REI’s executive vice president and COO from 1987 to 2000, and prior to that held numerous other positions at REI. In 2010, Mr. Madsen was appointed a director of West Marine Inc., a publicly traded retail company in the recreational boating sector. He also chairs West Marine’s compensation and leadership development committee and serves on its nominations and governance committee. Other boards on which Mr. Madsen serves include Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), the Western Washington University Foundation, Forterra, and the Youth Outdoors Legacy Fund.

Because of his varied business background and his experience in leading a large people-oriented and customer-service-driven organization, Mr. Madsen is qualified to serve on the Alaska Air Group Board.

Helvi K. Sandvik

Director since 2013

Age – 57

Ms. Sandvik serves on the Board’s Safety Committee. Since 1995, Ms. Sandvik has been president of NANA Development Corporation, a diversified business engaged in government contracting, oilfield and mining support, professional management services, and engineering and construction. She also serves on the not-for-profit board of the Native American Contractors Association and as an advisor to the Robert Aqqaluk Newlin Trust. She was director of the Federal Reserve Bank of San Francisco, Seattle Branch from 2004 to 2009 and served as its chair from 2008 to 2009. Ms. Sandvik also serves as a director of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group).

Ms. Sandvik’s business leadership experience and her intimate knowledge of the Native culture and transportation industry requirements in the state of Alaska qualify her to serve on the Alaska Air Group Board.

Katherine J. Savitt

Director since 2014

Age – 51

Ms. Savitt was appointed to the Alaska Air Group Board in October 2014. She is a member of the Board’s Compensation and Leadership Development Committee. Ms. Savitt is chief marketing officer for Yahoo!, responsible for global marketing and media. Prior to Yahoo!, Ms. Savitt was founder and CEO of Lockerz, a start-up focused on social commerce for Generation Z. Previously, she was executive vice president and chief marketing officer at American Eagle Outfitters, Inc., where she led both the global marketing efforts of the company’s portfolio of brands and the digital and e-commerce channels. Ms. Savitt has also served as vice president of strategic communications, content and entertainment initiatives for Amazon.com. She founded MWW/Savitt, an integrated marketing communications firm representing a diverse array of world class brands and consumer technology start-ups. She holds a bachelor’s degree from Cornell University. Ms. Savitt also serves on the boards of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), and the Vitamin Shoppe, Inc.

Ms. Savitt’s business and entrepreneurial expertise as well as her experience with digital

and e-commerce marketing channels and strategic communications support areas of strategic importance and qualify her for service on the Alaska Air Group Board.

23 J. Kenneth Thompson

Director since 1999

Age – 63

Mr. Thompson is chair of the Board’s Compensation and Leadership Development Committee and also serves on the Safety Committee. Since 2000, Mr. Thompson has been president and CEO of Pacific Star Energy LLC, a private energy investment company in Alaska with partial ownership in the oil exploration firm Alaska Venture Capital Group (AVCG LLC). From 1998 to 2000, Mr. Thompson served as executive vice president of ARCO’s Asia Pacific oil and gas operating companies in Alaska, California, Indonesia, China and Singapore. Prior to that, he was president of ARCO Alaska, Inc., the parent company’s oil and gas producing division based in Anchorage, Alaska. He currently serves on the boards of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), Pioneer Natural Resources Company, Tetra Tech, Inc., and Coeur Mining Corporation, as well as on the non-profit board of Provision Ministry Group. Mr. Thompson chairs the environmental, health, safety and social responsibility committee and serves on the governance and nominating and the audit committees of Coeur Mining Corporation. At Tetra Tech, Mr. Thompson serves on the strategy planning committee and chairs the compensation committee. At Pioneer Natural Resources, he serves on the governance and nominating, compensation and hydrocarbon reserves committees and chairs the health, safety and environmental committee.

Mr. Thompson’s business leadership and his breadth of experience in planning, operations, engineering, and safety/regulatory issues qualify him for service on the Alaska Air Group Board.

Bradley D. Tilden

Director since 2010

Age – 54

Mr. Tilden has been chairman of Alaska Air Group and of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group) since January 2014. He has served as president of Alaska Airlines since December 2008. In May 2012, Mr. Tilden was named president and CEO of Alaska Air Group and CEO of Alaska Airlines and Horizon Air. He served as executive vice president of finance and planning from 2002 to 2008 and as CFO from 2000 to 2008 for Alaska Airlines and Alaska Air Group, and prior to 2000, was vice president of finance at Alaska Airlines and Alaska Air Group. Before joining Alaska Airlines, Mr. Tilden worked for the accounting firm PricewaterhouseCoopers. He serves on the boards of Alaska Airlines and Horizon Air, Airlines 4 America, Pacific Lutheran University, and the Boy Scouts of America. Mr. Tilden also serves on and chairs the board of the Washington Roundtable.

Mr. Tilden’s role as CEO of Alaska Air Group and its operating subsidiaries, his deep airline experience, strategic planning skills and financial expertise qualify him to serve on the Air Group Board.

Eric K. Yeaman

Director since 2012

Age – 47

Mr. Yeaman serves on the Board’s Audit Committee. He is president and CEO of Hawaiian Telcom (a telecommunications company serving the state of Hawaii). Prior to joining Hawaiian Telcom in June 2008, he was senior executive vice president and COO of Hawaiian Electric Company, Inc. (HECO). Mr. Yeaman joined Hawaiian Electric Industries, Inc. (HEI), HECO’s parent company, in 2003 as financial vice president, treasurer and CFO. Prior to joining HEI, Mr. Yeaman held the positions of chief operating and financial officer for Kamehameha Schools from 2000 to 2003. He began his career at Arthur Andersen LLP in 1989. Mr. Yeaman serves on the not-for-profit boards of Queen’s

Health Systems, Hawaii Community Foundation, Hawaii Business Roundtable, The Nature Conservancy of Hawaii, Kamehameha Schools Audit Committee, Aloha United Way, and the Harold K.L. Castle Foundation. He is also a director of Alaska Airlines and Horizon Air (subsidiaries of Alaska Air Group), Alexander & Baldwin, the United States Telcom Association, and is a member of the Hawaii Asia Pacific Association.

24 Mr. Yeaman’s extensive business background, his experience as CEO of a public company, and his intimate knowledge of the culture of Hawaii (a region that accounts for a significant portion of Alaska’s business) qualify him to serve as a member of the Air Group Board.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE

ELECTION OF THE 11 DIRECTOR NOMINEES NAMED ABOVE.

UNLESS OTHERWISE INDICATED ON YOUR PROXY, THE SHARES WILL BE

VOTED FOR THE ELECTION OF THESE 11 NOMINEES AS DIRECTORS.

��

The Audit Committee has selected KPMG LLP (KPMG) as the Company’s independent accountants for fiscal year 2015, and the Board is asking stockholders to ratify that selection. Although current law, rules, and regulations, as well as the charter of the Audit Committee, require the Audit Committee to engage, retain, and supervise the independent accountants, the Board considers the selection of the independent accountants to be an important matter of stockholder concern and is submitting the selection of KPMG for ratification by stockholders as a matter of good corporate practice.

The affirmative vote of holders of a majority of the shares of common stock represented at the meeting and entitled to vote on the proposal is required to ratify the selection of KPMG as the Company’s independent accountant for the current fiscal year.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE RATIFICATION OF THE COMPANY’S INDEPENDENT ACCOUNTANTS.

| Proposal 3: Advisory Vote Regarding the Compensation of the

Company’s Named Executive OfficersPROXY STATEMENT SUMMARY

|

The Company is providing its stockholders

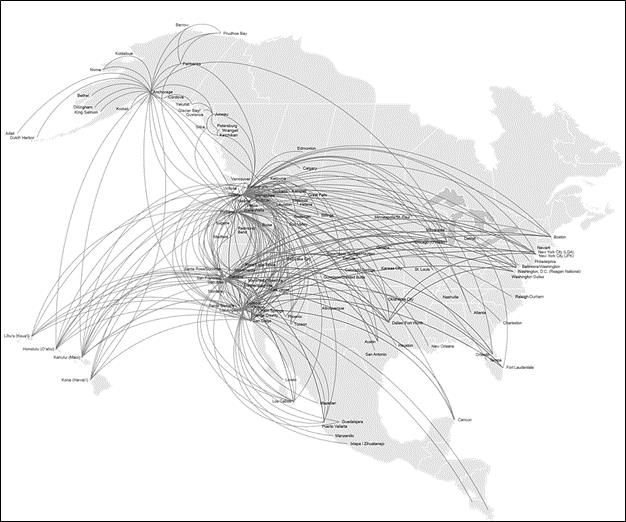

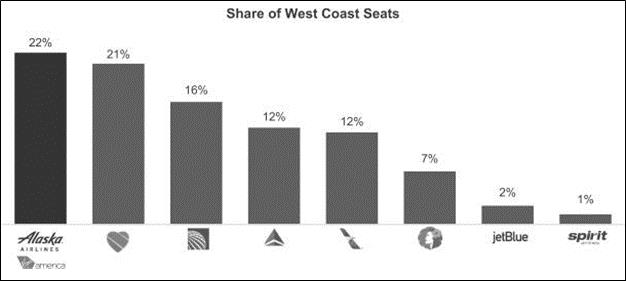

Our acquisition of Virgin America in late 2016 will position us as the 5th largest airline in the U.S. with the opportunityan unparalleled ability to castserve West Coast travelers . . .

. . . with award-winning customer service.

Our combined airline provides a non-binding, advisory votevast network of business and leisure travel options for customers living on the compensation of the Company’s Named Executive Officers as disclosed pursuant to the SEC’s executive compensation disclosure rules and set forth in this Proxy Statement (including the compensation tables and the narrative discussion accompanying those tables as well as in the Compensation Discussion and Analysis)West Coast . As described more fully in the Compensation Discussion and Analysis section of this Proxy Statement, the structure of the Company’s executive compensation program is designed to compensate executives appropriately and competitively and to drive superior performance. For the Named Executive Officers, a high percentage of total direct compensation is variable and tied to the success of the Company because they are the senior leaders primarily responsible for the overall execution of the Company’s strategy. The Company’s strategic goals are reflected in its incentive-based executive compensation programs so that the interests of executives are aligned with stockholder interests. Executive compensation is

. .

. . . and gives us a significant presence in all major West Coast metropolitan areas. | | | | | PROPOSALS TO BE VOTED ON Anchorage

46 Flights 9 Gates | Seattle 289 Flights 32 Gates | 13Portland 123 Flights 20 Gates | San Francisco 75 Flights 10 Gates Bay Area 108 Flights | LAX 78 Flights 12 Gates LA Basin 103 Flights |

designed

In addition, our partner portfolio provides expansive global travel utility.

From day one, the combined airline offers more seats from the West Coast than any other airline.

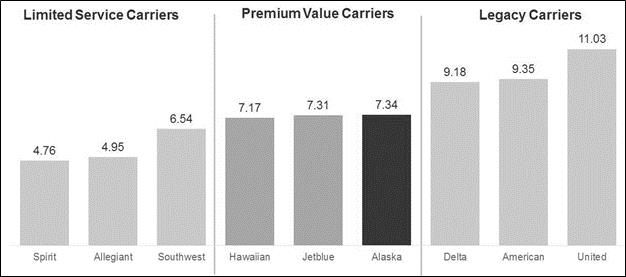

And, with costs lower than those of legacy carriers, . . . Stage-length Adjusted Cost per Available Seat Mile

CASM is for the 12 months ended December 31, 2016 (Alaska includes Virgin America) . . . the combination provides an expanded platform for significant growth of our low-fare, premium product.

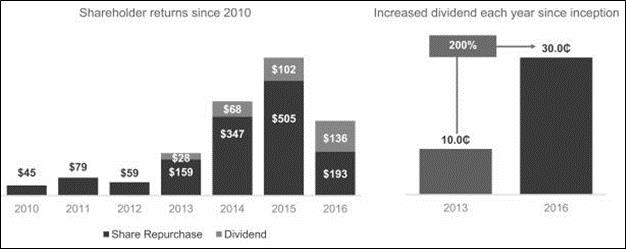

We have a history of returning capital to be internally equitable,our owners and consistently increasing our dividend.

With the 2016 acquisition, a greater portion of our capital has been allocated to reward executivesgrowing our business, which will create significant value for responding successfully to business challenges facing the Company, and to take into consideration the Company’s size relative to the restour owners.

Highlighted below is a summary of the industry. The Compensation Discussion and Analysis section ofselected information provided in this Proxy Statement. Please review the entire Proxy Statement describesand Alaska Air Group’s Annual Report on Form 10-K for the fiscal year ending December 31, 2016 before voting your shares.

Matters To Be Voted On Item for Business | Board Recommendation | Effect of Abstention | 1. Election of 10 Directors | FOR each Director Nominee | None | 2. Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers | FOR | A Vote Against | 3. Advisory Vote to Approve the Frequency of the Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers | FOR | A Vote Against | 4. Approve an Amendment to the Company’s Certificate of Incorporation to Increase the Number of Authorized Shares | FOR | A Vote Against | 5. Ratify the Appointment of KPMG LLP as the Company’s Independent Registered Public Accountants for the Fiscal Year 2017 | FOR | A Vote Against | 6. Consider a Stockholder Proposal Regarding Changes to the Company’s Proxy Access Bylaw | AGAINST | A Vote Against |

Governance Highlights As part of Alaska Air Group’s commitment to high ethical standards, our board follows sound governance practices. These practices are described in more detail in our Corporate Governance Guidelines, which are available on the Company’s website at www.alaskaair.com. Topic | Practice | Independence | • 9 out of 10 nominees are independent. • Board committees are composed exclusively of independent directors. | Lead Independent Director | • The board has appointed a lead independent director who: o acts as liaison between the independent directors and the board chairman; o presides at meetings where the chairman is not present or has a conflict of interest; o approves board meeting agendas and meeting schedules; o leads the independent directors’ evaluation of the CEO; and o interviews independent directors annually prior to nomination. | Executive Sessions | • Independent directors meet regularly without management. | Annual Election | • All directors are elected annually to one-year terms. | Majority Voting | • In uncontested elections, directors are elected by a majority of votes cast. | Director Evaluations | • The board and each committee conduct annual self-evaluations. • Every three years, director evaluations are conducted by a third party. | Stock Ownership | • Each director is expected to hold shares of Alaska Air Group stock equivalent to three times his or her annual cash retainer. | Other Directorships | • Directors are encouraged to limit service to no more than four other public company boards. | Stockholder Communications | • The board has adopted a protocol to allow those stockholders with long-term significant holdings of our stock to meet directly with board members on appropriate topics. | Poison Pill | • The Company does not have a stockholder rights plan. | Proxy Access | • Stockholders who meet certain requirements may include director nominees in the Company’s proxy statement. | Right to Call Special Meeting | • Stockholders holding 10 percent or more of the outstanding stock have the right to call a special meeting. | Confidential Voting | • Records that identify the vote of a particular stockholder are kept confidential from the Company except in a proxy contest or as required by law. | Single Voting Class | • Common stock is the only class of voting shares outstanding. | Director Tenure | • Directors are subject to term and age limits as described in our Corporate Governance Guidelines. |

Our Board All nominees meet the New York Stock Exchange governance standards for director independence, except for Mr. Tilden, who is not independent due to his position as an executive officer. Nominee and Principle Occupation | Age | Director Since | Committee Membership | Patricia M. Bedient Former Executive Vice President, The Weyerhaeuser Company | 63 | 2004 | Lead Independent Director Audit Governance and Nominating | Marion C. Blakey President and CEO, Rolls-Royce North America | 68 | 2010 | Safety Compensation and Leadership Development | Phyllis J. Campbell Chairman, JPMorgan Chase & Co. Pacific Northwest Region | 65 | 2002 | Governance and Nominating (Chair) | Dhiren R. Fonseca Partner, Certares LP | 52 | 2014 | Audit | Jessie J. Knight, Jr. Former Executive Vice President External Affairs, Sempra Energy | 66 | 2002 | Governance and Nominating Safety (Chair) | Dennis F. Madsen Consultant and Former President and CEO, Recreational Equipment, Inc. | 68 | 2003 | Compensation and Leadership Development Audit | Helvi K. Sandvik Former President, NANA Development Corporation | 59 | 2013 | Safety | J. Kenneth Thompson President and CEO, Pacific Star Energy LLC | 65 | 1999 | Compensation and Leadership Development (Chair) Safety | Bradley D. Tilden Chairman, President and CEO, Alaska Air Group, Inc. | 56 | 2010 | | Eric K. Yeaman President and COO, First Hawaiian Bank | 49 | 2012 | Audit (Chair) |

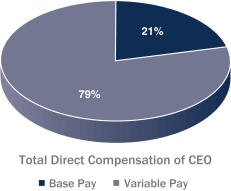

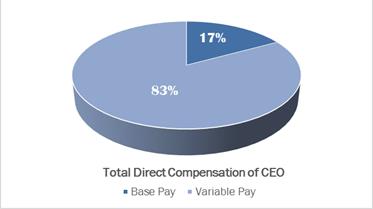

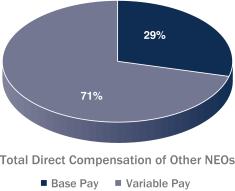

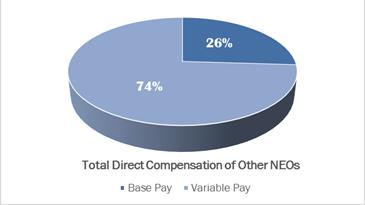

Executive Compensation Practices Our executive compensation programsprogram is aligned with our business strategy and is designed to attract and retain top talent and reward the decisions madeachievement of key business goals. The following practices ensure alignment of interests between stockholders and executives and are considered good governance by theour Compensation and Leadership Development Committee during 2014. Highlightsand by the majority of these executive compensation programs include the following:our stockholders. Base Salary

Topic | Practice | Pay for Performance | • A significant percentage of total direct compensation is based on the achievement of performance-based goals that are challenging, yet attainable and that drive achievement of the Company’s business strategy. • The Committee considers company performance when setting CEO pay. | “Say on Pay” | • We annually ask stockholders to provide an advisory vote on our pay practices, which the Committee considers when setting CEO pay. | Stock Ownership Requirements | • Our minimum stockholding requirements are 5 times base salary for the CEO, 3 times base salary for executive vice presidents of Alaska Airlines, and 1.5 times base salary for the president and CEO of Horizon Air. | Change-in-Control Provisions | • We have double-trigger change-in-control provisions that require the actual or constructive termination of employment and the consummation of a change-in-control transaction. | Clawback Policy | • Our policy allows recovery of incentive cash or equity compensation that is based on financial statements that were subsequently restated due to the individual’s fraudulent or grossly negligent act or omission. | Independent Compensation Consultant | • The Committee retains a compensation consultant that does not provide any other services to the Company. | Hedging of Company Stock | • Executive officers and board members may not engage in transactions that create a hedge against fluctuations in the price of Alaska Air Group stock. | Pledging of Company Stock | • Executive officers and board members may not pledge Alaska Air Group stock as collateral for any obligation. | Severance Tax Gross-Ups | • Our change-in-control and severance arrangements do not provide for tax gross-ups. | Employment Contracts | • None of our named executive officers has an employment contract. | Repricing of Stock Options | • Our equity incentive plan does not permit repricing or exchange of underwater stock options without stockholder approval. |

In general, for the Named Executive Officers, the Committee targets base salary levels at the 25th percentile relative to the Company’s airline peer group with the opportunity to earn market-level or above compensation through short- and long-term incentive plans that pay when performance objectives are met.

Annual Incentive Pay

Board Leadership The Company’s Named Executive Officers are eligible to earn annual incentive pay under the broad-based Performance-Based Pay Plan, in which all employees participate and which is intended to motivate the executives to achieve specific Company goals. Annual target performance measures reflect near-term financial and operational goals that are consistent with the strategic plan. Long-term Incentive Pay

Equity-based incentive awards that link executive pay to stockholder value are an important element of the Company’s executive compensation program. Long-term equity incentives that vest over three- or four-year periods are awarded annually, resulting in overlapping vesting periods that are designed to discourage short-term risk taking and to align Named Executive Officers’ long-term interests with those of stockholders while helping the Company attract and retain top-performing executives who fit a team-oriented and performance-driven culture.

In accordance with the requirements of Section 14A of the Exchange Act (which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act) and the related rules of the SEC, the Board of Directors will request your advisory vote on the following resolution at the 2015 Annual Meeting:

RESOLVED, that the compensation paid to the Named Executive Officers, as disclosed in this Proxy Statement pursuant to the SEC’s executive compensation disclosure rules (which disclosureboard leadership generally includes the Compensation Discussion and Analysis, the compensation tables and the narrative discussion that accompanies the compensation tables), is hereby approved.

This proposal regarding the compensation paid to the Company’s Named Executive Officers is advisory only and will not be binding on the Company or the Board and will not be construed as overruling a decision by the Company or the Board or as creating or implying any additional fiduciary duty for the Company or the Board. However, the Compensation and Leadership Development Committee, which is responsible for designing and administering the Company’s executive compensation program, values the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for the Named Executive Officers. Stockholders will be given an opportunity to cast an advisory vote on this topic annually, with the next opportunity occurring in connection with the Company’s annual meeting in 2016.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT PURSUANT TO THE SEC’S EXECUTIVE COMPENSATION DISCLOSURE RULES.

| | | 14 | | PROPOSALS TO BE VOTED ON |

| Proposal 4: Stockholder Proposal Regarding Independent Board Chairman |

Mr. John Chevedden has given notice of his intention to present a proposal at the 2015 Annual Meeting. Mr. Chevedden’s address is 2215 Nelson Avenue, No. 205, Redondo Beach, California 90278, and Mr. Chevedden represents that he has continuously owned no less than 100 shares of the Company’s common stock since July 1, 2013. Mr. Chevedden’s proposal and supporting statement, as submitted to the Company, appear below.

The Board of Directors opposes adoption of Mr. Chevedden’s proposal and asks stockholders to review the Board’s response, which follows Mr. Chevedden’s proposal and supporting statement below.

The affirmative vote of the holders of a majority of the shares of common stock present, in person or represented by proxy at the meeting and entitled to vote is required to approve this proposal.

ALK: Rule 14a-8 Proposal, November 2, 2014

Proposal 4 - Independent Board Chairman

Resolved: Shareholders request that the Board of Directors adopt a policy that the Chair of the Board of Directors shall be an independent director who is not a current or former employee of the company, and whose only nontrivial professional, familial or financial connection to the company or its CEO is the directorship. The policy should be implemented so as not to violate existing agreements and should allow for departure under extraordinary circumstances such as the unexpected resignation of the chair.

When our CEO is our board chairman, this arrangement can hinder our board’s ability to monitor our CEO’s performance. Many companies already have an independent Chairman. An independent Chairman is the prevailing practice in the United Kingdom and many international markets. This proposal topic won 50%-plus support at 5 major U.S. companies in 2013 including 73%-support at Netflix.

This topic is of additional importance for Alaska Air because our company seems to have a default type of quasi-lead director. Plus there are questions on the independence of 5 of our directors who each have 10 to 32-years of long-tenure: Patricia Bedient, Jessie Knight, Phyllis Campbell, Kenneth Thompson and Byron Mallott. GMI Ratings, an independent investment research firm, said long-tenured directors can form relationships that may compromise director independence and therefore hinder director ability to provide effective oversight of our CEO/Chairman. These 5 directors ontrolled [sic] 87% of the votes on our 3 most important board committees.

Other concerns with director oversight include the assignment of Kenneth Thompson to our executive pay committee as chairman when he is potentially overextended with seats on 4 public boards. And Alaska Air did $2.7 million of business with Helvi Sandvik’s company.

Additional issues (as reported in 2014) are an added incentive to vote for this proposal:

GMI was concerned with excessive CEO perks and pension benefits. Unvested equity awards partially or fully accelerate upon CEO termination. Meanwhile shareholders had a potential 14% stock dilution. GMI rated Alaska Air D in accounting. Alaska Air reported a $120 million charge related to how it reports its revenue from its Bank of America credit card agreement (October 2013).

Returning to the core topic of this proposal from the context of our clearly improvable corporate governance, please vote to protect shareholder value:

Independent Board Chairman - Proposal 4

| | | PROPOSALS TO BE VOTED ON

| | 15 |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE AGAINST PROPOSAL 4

FOR THE FOLLOWING REASONS:

At the Company’s 2014 annual meeting of stockholders, Mr. Chevedden proposed that the Board of Directors adopt this policy. The Board of Directors opposed the proposal last year, and stockholders rejected the proposal with over 80 percent of the votes cast opposed to it.

The Board maintains that the current leadership structure best serves the interests of the Company and its stockholders. The Board’s leadership structure generally features a combined chairman and CEO role andwith a strong, independent lead director. However, the Board has discretion to depart from this structure where circumstances warrant and has done so in the past. The proponent would eliminate the Board’s flexibility to combine the chairman and CEO roles except in “extraordinary circumstances.” The Board believes that it is not in the shareholders’ interests to restrict the Board’s discretion in this respect.

The Board’s existing leadership structure is effective and appropriately flexible

In the Board’s view, the leadership structure in which the chairman and CEO roles are combined serves a number of important goals. A chair/CEO facilitates the flow of information between management and the Board, keeps the Board informed about the Company’s business and the airline industry, and consults with board members in a timely manner about important issues facing the Company. The Board also believes that the current structure provides focused leadership for the Company, helps ensure accountability for the Company’s performance and promotes a clear, unified vision for Alaska Air Group by assuring that the strategies adopted by the Board will be well positioned for execution by management. The Board regards this leadership structure as a strong contributor to the Company’s recent success.

The Board considers many factors in determining optimal leadership structure

In choosing to combine the roles of chairman and CEO, the Board takes into consideration the highly technical nature of the airline industrybusiness and the complexityimportance of deep, industry-specific knowledge and dynamic naturealong with a thorough understanding of the Company’s business environment. Combining the roles also provides a clear leadership structure for the management team. Because the CEO has a depth of understanding of the many complexities of the airline business, the regulatory environment, and operating environment.the Company’s strategy – all of which are critically important to the Company’s performance – the Board believes that he or she generally is best suited to serve as chairman and to preside over the majority of the Board’s discussions, with the exception of the regular sessions of the independent directors, which are led by the independent lead director. By creating an independent lead director role with specific authority, the Board is able to ensure objective evaluation of management decisions and performance and to provide independent leadership for director and management succession planning and other governance issues. The lead director’s responsibilities are: to preside at all meetings where the board chairman is not present or where the board chairman could be perceived as having a conflict of interest, including but not limited to periodic meetings of non-management directors as described in Section 1.1.12 of the Company’s Corporate Governance Guidelines; to approve the board meeting agendas and meeting schedules to ensure sufficient time for discussion, and to approve information sent to the board members; to lead the independent directors’ annual evaluation of the CEO; to conduct interviews of independent directors annually, including a discussion of each individual director’s self-assessment of his or her contribution prior to nomination for election; to discuss any proposed changes to committee assignments with each affected director in advance of making committee membership recommendations to the Board; to be available for consultation and direct communication if requested by a major shareholder; and such other duties as may be described in the Company’s Corporate Governance Guidelines, including serving as liaison between the chairman and independent directors and calling meetings of the independent directors, if appropriate. Notwithstanding the Board’s preference for combining the roles of chairman and CEO, the Board may separate the CEO and chairman roles from time to time at its discretion, and has done so previously on a temporary basis in connection with the transition to a new CEO. In addition,deciding whether to separate the roles, the Board considers, among other things, the experience and capacity of the sitting CEO, the rigor of independent director oversight of financial, operational and safety regulatory issues, the current climate of openness between management and the Board, and the existence of other checks and balances that help ensure independent thinking and decision-making by directors. Restricting Board discretion would be detrimental to stockholders’ interestsExecutive Sessions and Lead Director

The proposal seeksAlaska Air Group Board holds regular executive sessions of independent directors quarterly, as provided in the Company’s Corporate Governance Guidelines. The lead director presides over these executive sessions. Risk Oversight Alaska Air Group has adopted an enterprise-wide risk analysis and oversight program. This program is designed to mandate one leadership structure that would apply except in “extraordinary circumstances.” Becauseidentify the various risks faced by the organization, assign responsibility for managing those risks to

individual executives within the management ranks and align those management assignments with appropriate board-level oversight. Responsibility for the oversight of the presenceprogram itself has been delegated to the Audit Committee. In turn, the Audit Committee has tasked an executive responsible for enterprise risk (risk officer) with the day-to-day design and implementation of the independence safeguards noted above,program. Under the Board believes it is not only unnecessary, but that it would be detrimentalprogram, an Alaska Air Group risk matrix has been developed and the organization’s most prominent risks have been identified, responsibility has been assigned to restrict the Board’s leadership structure to one form. The membersappropriate executives, and assignments have been aligned for appropriate board oversight, including oversight of the Board have experience with and knowledge of the challenges and opportunities the Company faces at any given time, and therefore they are in the best position to choose the leadership structure that is most appropriate for the situation. The Board’s commitment to select a leadership structure that is most appropriate for the Company and its stockholders is best evidencedsafety-related risks by the Board’s decisionSafety Committee. Responsibility for managing these risks includes strategies related to separateboth mitigation (acceptance and management) and transfer (insurance). The risk matrix is updated regularly. At a minimum, the chairmanAudit Committee receives quarterly updates regarding the program and CEO positions during 2012-2013 in connectionan annual in-person review of the program’s status by the risk officer. The program also provides that the Audit Committee work with the transitionrisk officer and Alaska Air Group’s management executive committee to a new CEO. | | | 16 | | PROPOSALS TO BE VOTED ON |

Tenannually identify the most pressing risk issues for the next year. This subset of the Board’s eleven directors are independent

The Company’s Governance Guidelines require that at least 75% of directors satisfy independence criteria establishedrisk matrix is then designated for heightened oversight, including periodic presentations by the SECdesignated management executive to the appropriate board entity. Furthermore, these areas of emphasis regarding risk are specifically reviewed and discussed with executive management during an annual executive officer planning session, held during the NYSEthird quarter of each year, and those set forth inare incorporated into the Director Independence sectiondevelopment of this Proxy Statement. At present, the Board has determined that 10 outCompany’s strategic plan for the coming year.

As part of 11 directors, or 91%, are independent according to these standards. The Board has a strong, independent lead director

The Board’s lead director is appointed by and from among the independent board members and has specific authority that ensures objective, independentits oversight of management’s strategic decisions, risk management, succession planning, and executive performance and compensation. The authority and responsibilities of the lead director are outlined in the Company’s Governance Guidelines, which are available atwww.alaskaair.com. The lead director:

serves as liaison between the chairman and the independent directors;

is authorized to call a meeting of the independent directors at any time;

is authorized to call a meeting of the full board at any time;

presides at meetings where the board chairman is not present or where he/she could be perceived as having a conflict of interest;

presides over quarterly executive sessions of the independent directors;

approves board meeting agendas and meeting schedules to ensure that appropriate time is allotted to topics of importance;

approves information sent to board members;

leads the independent directors’ annual evaluation of the CEO’s performance;

conducts interviews of independent directors annually prior to nomination for election;

discusses proposed changes to committee assignments with each director; and

makes herself or himself available for consultation and direct communication with major stockholders.

Responding to the proponent’s assertion that the Company has “a default type of quasi-lead director,” the Board wishes to state that the lead director role and responsibilities are meaningful and carefully tailored to promote the Board’s oversight and independence obligations.

The governance structure fosters board independence

The Board believes the Company’s corporate governance practices, beyond those allowing for a strong lead director, make it unnecessary to require an independent chairman. For example:

Each of the Audit, the Compensation and Leadership Development, and the Governance and Nominating Committees is required to be composed solely of independent directors. This means that the oversight of key matters, such as the integrity of financial statements, CEO performance, executive compensation the nomination of directors, and evaluation of the Board and its committees, is entrusted exclusively to independent directors.

The Board and its committees meet regularly in executive session without management, and they have access to management and the authority to retain independent advisors, as they deem appropriate.

All independent directors play a role in overseeing the CEO’s performance, with the Board routinely discussing this subject in executive session without the CEO present.

The Company has a 15-year maximum term limit for new directors elected since 2012 in order to ensure fresh perspectives on the Board.

| | | PROPOSALS TO BE VOTED ON

| | 17 |

Alaska Air Group governance practices ranked among the best by ISS

As of the printing of this proxy statement, Alaska Air Group maintains a governance rating of “1” from Institutional Shareholder Services (ISS), which is the highest ranking possible.

Additional information

In considering how to vote on the proposal, it is important to note that the proponent has made several assertions that are false or misleading. The assertions are not directly related to the proposal to require an independent chairman, and they are addressed here in the interest of providing full information to investors.

The proponent correctly cites the fact that five directors serving on the Board as of November 2, 2014 have tenures of 10 years or more, and the Board wishes to provide the following context:

The Board has added five independent directors over the past five years, and two long-tenured directors stepped down in 2014, resulting in an average tenure of seven years among the Company’s ten independent directors. The Board has a 15-year maximum term limit for directors elected since 2012 in order to ensure fresh perspectives on the Board. The Board values the experience of its directors and views a diversity of tenure as an asset that compromises neither directors’ independence nor their ability to oversee the CEO.

The proponent incorrectly states that five long-tenured directors (as of November 2, 2014) “controlled 87% of the votes on our three most important board committees.”